solar ppa

Lock in electricity costs now with no money down

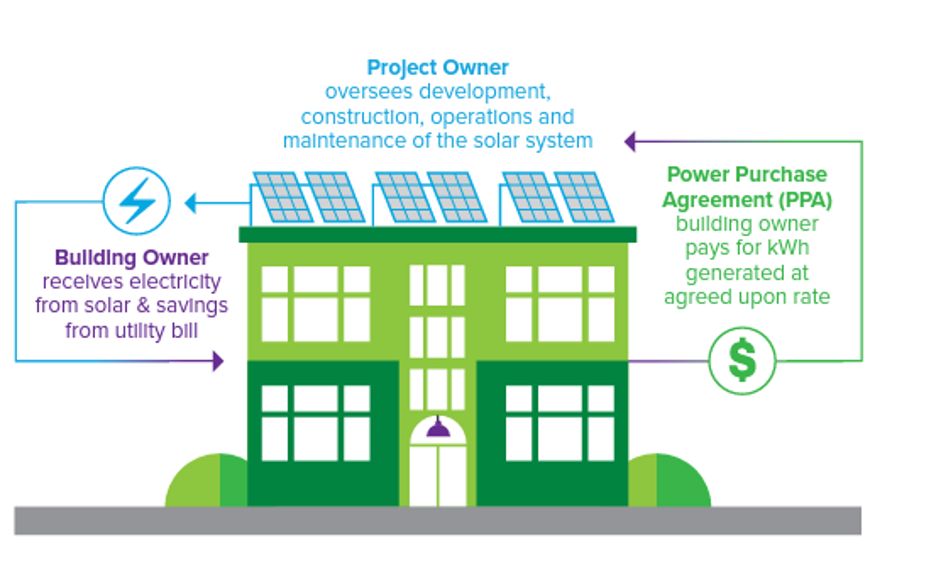

Have you been wondering if solar could help lower your electricity costs? When every dollar matters, finding a way to control electricity costs can have a positive impact on your mission and bottom line. Through the Connecticut Green Bank’s Solar PPA you can go solar with no money down, and receive immediate savings on your electricity. A power purchase agreement, or PPA, allows you to purchase the electricity generated by the solar system on your building often at a significant discount to grid power. The Green Bank oversees the development and management of the system minimizing your worries.

|

|

|

| No upfront installation costs and no new debt |

Reduce your bill by locking in low electricity costs | Positive cash flow in year one |

solar ppa

Lock in electricity costs now with no money down

Have you been wondering if solar could help lower your electricity costs? When every dollar matters, finding a way to control electricity costs can have a positive impact on your mission and bottom line. Through the Connecticut Green Bank’s Solar PPA you can go solar with no money down, and receive immediate savings on your electricity. A power purchase agreement, or PPA, allows you to purchase the electricity generated by the solar system on your building often at a significant discount to grid power. The Green Bank oversees the development and management of the system minimizing your worries.

|

|

|

| No upfront installation costs and no new debt | Reduce your bill by locking in low electricity costs | Positive cash flow in year one |

With a PPA from the Green Bank you can:

- “Go solar” without any upfront costs or incurring any debt.

- Lock in low electricity costs and realize predictable energy production over the standard 20-year agreement term.

- See positive cash flow in year one.

- Let your customers, employees, residents, competitors, and community see that you’re making a positive impact on the environment by harnessing the power of the sun.

- Rest easy knowing that you don’t need to maintain the system or manage equipment and warranty issues.

- Have the option of purchasing the system at fair market value in the future.

- Transfer the PPA to a new building owner if you sell the property, possibly increasing the sales price of your building.

Eligibility requirements

- Commercial and nonprofit properties: Properties must meet C-PACE financing requirements or – on an exception basis – alternative underwriting criteria. All types of privately owned commercial properties (industrial, office, retail, agricultural, multifamily, faith-based institutions, recreational facilities, museums, and more) that are current on their property tax (if applicable) and assessment payments can use the C-PACE program to make energy improvements. Nonprofits can be assigned a tax identification number to make payments through the program.

- Municipal properties and other publicly owned institutions: Public properties and institutions can use the Green Bank Solar PPA to add solar to their buildings. Municipalities must have an investment grade credit rating in order to qualify, or otherwise subject to alternative underwriting criteria.