c-pace new construction financing

Building better with C-PACE

Assembling the capital needed to develop new commercial and industrial properties is increasingly challenging and expensive. C-PACE (Commercial Property Assessed Clean Energy) new construction financing can help provide capital to new construction, repositioning, and gut renovation projects. Developers and owners can use this innovative financing as part of their capital stack when designing for more efficient, higher performing buildings.

|

|

|

| Invest in green energy with confidence | Reduce the cost of capital | Develop higher-performing buildings |

c-pace new construction financing

Building better with C-PACE

Assembling the capital needed to develop new commercial and industrial properties is increasingly challenging and expensive. C-PACE (Commercial Property Assessed Clean Energy) new construction financing can help provide capital to new construction, repositioning, and gut renovation projects. Developers and owners can use this innovative financing as part of their capital stack when designing for more efficient, higher performing buildings.

|

|

|

| Invest in green energy with confidence | Reduce the cost of capital | Develop higher-performing buildings |

What is C-PACE new construction financing?

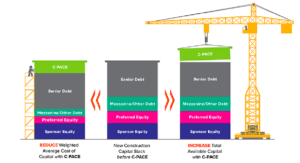

Developers can use C-PACE new construction financing to complete their capital stack and lower their weighted average cost of capital – or increase the total available capital – with access to affordable, long-term financing that may take the place of more expensive debt and equity. Up to 35 percent of the Total Eligible Construction Costs (TECC) is available for terms up to 25 years.

Developers and owners can use this innovative financing as part of their capital stack to design more efficient, higher performing buildings, helping them to afford more efficient and higher quality materials and systems measures that boost a project’s long-term sustainability and create a more cost-effective, comfortable and competitive property and making their investment more attractive.

How it works

Developers will need to demonstrate their building’s designed energy performance through a whole-building energy model. Multifamily properties may also demonstrate building performance using the HERS Index (Home Energy Rating System). The building’s designed energy performance above code determines the percentage of total eligible construction cost (TECC) that is eligible for C-PACE new construction financing through the Green Bank or a qualified capital provider, with up to 35 percent of TECC eligible for the highest performing buildings.

Designing an all-electric, net-zero building or incorporating “bonus technologies,” including electric vehicle charging stations, battery storage systems, high-efficiency heat pumps, heat pump water heaters, fuel cells, and solar photovoltaic systems, make a project eligible for the maximum financing amount.

Developers can invest with confidence. They enjoy the benefits of C-PACE, a proven financing mechanism where improvements are repaid through an assessment placed on the property. The Green Bank’s Technical Administrator will conduct an independent review of the energy modeling and projected energy performance of projects.

Eligible measures

Financing helps pay for a variety of hard and soft costs directly related to a building’s design and construction. Learn more about what can be included in the TECC.